Stock trading is one of the most popular forms of trading in the financial markets. Many beginner traders who are still learning the ropes are perhaps focused on observing trends and placing trades. However, intermediate traders who are ready to hone their skills should place a bigger emphasis on creating a strategy to incorporate into their overall trading plan. This can make you more efficient when trading, and these strategies can also introduce new opportunities.

In this article, we will cover 5 common stock trading strategies for intermediate traders. We will go through what they are and when to best use them. We will also offer some advice on how you can improve your skills when you apply new strategies and trade stocks online.

Defining stock trading strategy

Before we begin, it is worth taking some time to define what a trading strategy is. Sometimes, a trader may confuse one’s trading strategy with one’s trading style.

To clarify, a trading strategy is about methodology. It concerns entry and exit points, theoretical principles to follow, and traders applying these principles to their real-life trades. Many traders use technical analysis to help with executing their trading strategies.

A trading style, on the other hand, is rooted in a trader’s preferences for how they prefer to execute their trades. This can be their preferred trading timeframe, how frequently they prefer to trade, and other factors.

Range trading

One of the most common trading strategies is range trading. This is when a trader finds opportunities within a range. Usually, these traders define this range by identifying lines of support and resistance. Range trading is good for short-term trading, but traders can also participate in long-term trading using the strategy.

When to use range trading

Traders can choose range trading when they are comfortable with technical analysis, and they can identify lines of support and resistance. Range trading is also suitable for traders who cannot identify a trend in the current market price pattern.

Trend trading

Another popular trading strategy is trend trading, which is heavily reliant on technical analysis. Traders look at price patterns and try to identify trends – specific patterns – that allow them to speculate on future price movements through identifying retracements. These retracements send traders signals to open and close trades.

When to use trend trading

When traders trade depends on the trend they identify. However, all trend trading is best when trading is done over a few hours to a few weeks. This allows trends to develop and run their course. Therefore, many trend traders are also position and swing traders who keep their positions open for a while.

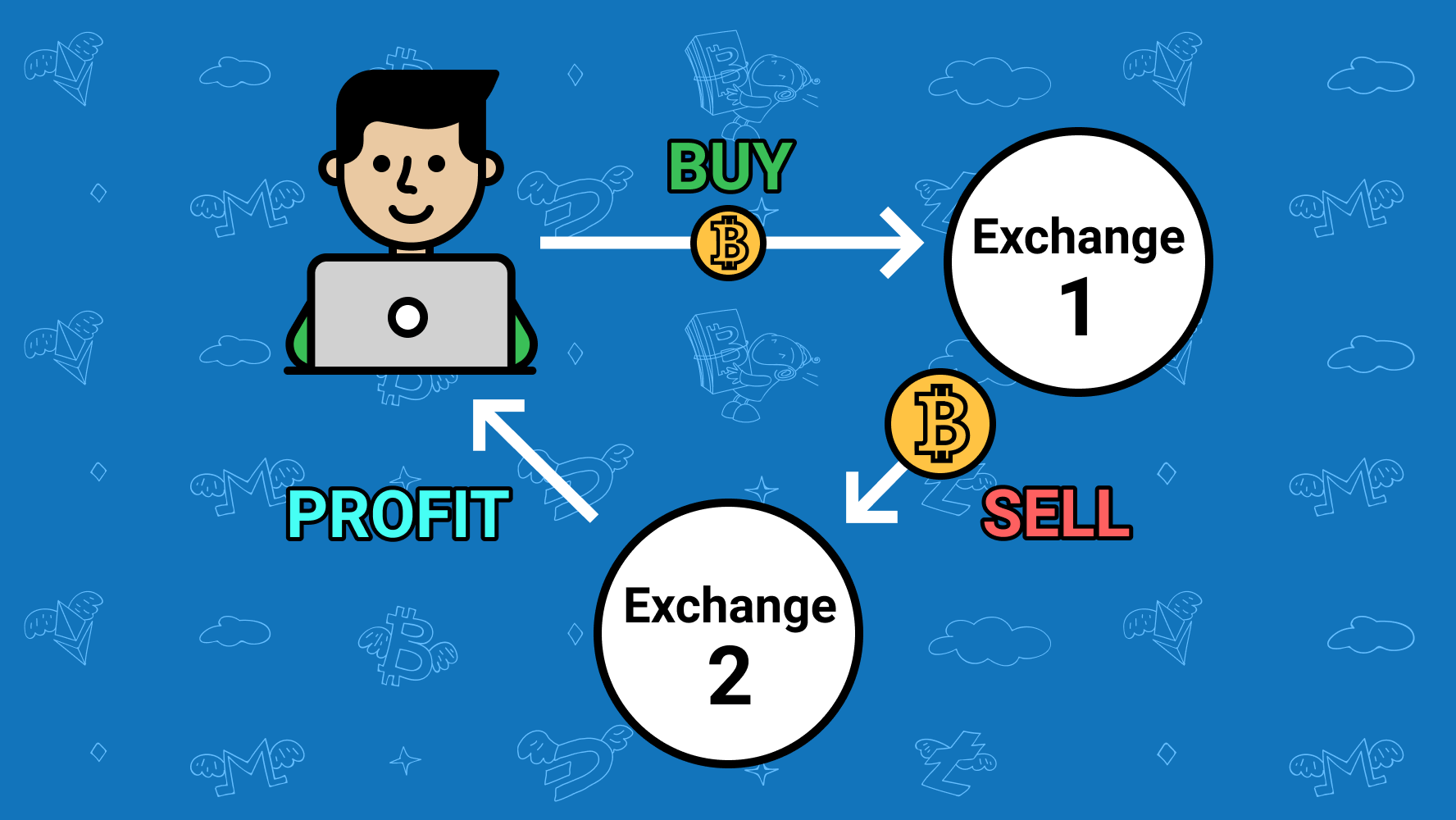

Arbitrage trading

Another popular trading strategy is arbitrage trading. This is when a trader makes a transaction (or a series of transactions) to allow them to generate profit without undergoing any risk. Traders usually do this by looking across markets and identifying price discrepancies between assets. They buy an asset in one market and sell it in another, and they make a profit by pocketing the difference between prices in the markets.

The good thing about arbitrage trading is that it creates a profit opportunity for the trader, but it also helps the wider market. When there are inequalities in asset prices between markets, arbitrageurs can correct these incorrect prices and move them back in line. As an arbitrageur, you also contribute to overall market liquidity when you buy and sell assets at different prices.

When to use arbitrage trading

Theoretically, there should not be opportunities for arbitrage trading if markets were efficient enough to regulate prices. However, the truth is that there are sometimes price differences between markets that traders can find and exploit if they are quick enough.

Momentum trading

The fourth most common trading strategy is momentum trading. This is when traders enter and exit trades based on the overall direction of the market and the trends that are going strong. In other words, they identify where there is momentum in the market and jump on by placing a trade. They then exit the trade when the price movement loses its momentum or reverses.

When to use momentum trading

Traders can participate in momentum trading whenever there is a huge price movement in the market that indicates a trend is going strong. This is because momentum traders take advantage of market volatility in either direction. If the market is rapidly on the upswing, traders will take bullish positions. If the market is rapidly on a downturn, traders will take bearish positions. The goal is simply to take advantage of large price movements as they occur.

Reversal trading

Reversal trading is a strategy that requires traders to identify existing trends that are on the verge of changing directions. Traders wait for this reversal and place trades once it happens, as there will be plenty of the trend to play out when it enters its new cycle. The good thing about reversal trading is that traders can spot trend reversals regardless of whether the market is bullish or bearish.

One thing that traders must be careful of is reading trends properly, to ensure they are reversing and not simply retracing. They can double-check how a trend is performing by using the Fibonacci retracement, a technical analysis tool that allows users to identify retracement levels. A reversal will surpass retracement levels, which is what you should look out for.

When to use reversal trading

Traders can participate in reversal trading when there is a trend that appears as though it has run its course. This is usually when a trend has been ongoing for a while and there is a dip in the price movement that indicates there may be a reversal. As the reversal of an old trend (or in other words, the birth of a new trend) can stretch over a long period, this strategy is most well-suited for medium to long-term trading.

The common ground between strategies

There is one similarity between all the strategies we have explored so far, and it is the use of technical analysis. Many of these strategies are highly theoretical, and it is important for traders to understand how to use analysis tools such as support and resistance identifiers, Fibonacci retracements, moving averages, the average directional index (ADX), and the relative strength index (RSI). Therefore, most of these strategies are more suited to intermediate traders who have a sense of technical analysis.

How to improve your stock trading skills

If you want to implement these strategies in your arsenal in the future, you should take care to spend time on practice. Some traders like to use demo accounts to place trades so they will not risk real money. Others prefer to go live and learn as they go with smaller amounts of trading capital at the outset. Regardless of your preferred method, the only way you can improve is to keep practicing.

Conclusion

Whether you have found any of these stock trading strategies suitable, the takeaway is that having a strategy and a plan can greatly improve your efficiency as a trader. If you are eager to learn more about individual technical analysis tools and trading strategies, you can look out for online resources with more in-depth explanations.

If you are interested in reading more about trading, check out this article on Why You Should Invest in Paypal Stocks.