CRM (Customer Relationship Management) software is at the heart of the Banking industry. In the past and currently, we have seen a vast change in this sector. It revamped everything to get valuable customers. Credit goes to their investment in the greatest Banking CRM software. Their goal of getting a fruitful investment is finally done.

Are you still pondering whether to invest in the CRM in Banks business or not? No investment in CRM software means you are leaving money on the table. To acquire and engage with tons of customers, use this software to take your industry to new heights. We will elaborate here on each and every point. Read out the article word for word below-

What is CRM for Banks?

CRM for Banks means it helps this business to get the customer and to find out what they need the most. In this way, taking the help of CRM helps to deliver the right solution at the opportune time to the customer. In addition to this, you can provide them with awesome Customer service. Remember: Getting engaged with them can make them feel valued.

Real-Life scenario: You run a Marketing Campaign to catch the end number of prospects to turn them into paying customers. But it is imperative for your business to check out the Email statistics properly. Well, how great it would be when the software opens up a box full of crucial information that you are looking for. Banking CRM software helps to share details like how many users opened, how many clicked on a promotion campaign of a banking product, and the list goes on.

- 40% of customer retention will increase through the CRM system

- Improvement in Sale approximately 29%

- Customer satisfaction rate will increase up to 47% when you have the best CRM

- A CRM revenue is expected to reach $80 billion in 2025.

- More than 82% of companies use this system for reporting sale functionality

The above key statistics indicate that no matter what type of business you are running, CRM is ultimate. If it is about CRM in Banks, it can help your business to see revenue soar.

Benefits:

The first biggest advantage to adapt the CRM system is the 360-degree customer view. Your bank organization can check out the entire information of every individual customer. It will be easier to know what they purchased from your bank in the past and what they are looking for. Before your competitor dives in to get them, be smart with your CRM. One more thing, after each interaction with the second person the profile will be updated in your CRM. All thanks to the Automation function here.

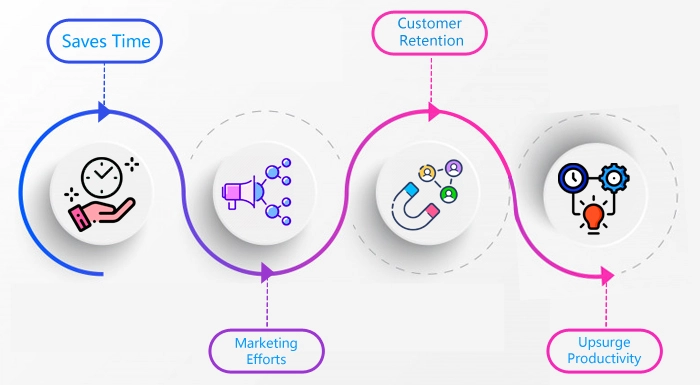

The second exceptional benefit of this software is you can create personalized marketing campaigns. This software aids to know customer purchasing habits. Is it an opportunity for your Banking industry? Yes, it is because you can create a Marketing Campaign in that way. Share those campaigns at the appropriate time to achieve greater results. Plus it is helpful to know Email stats. Better to gauge how your campaign performed in the industry.

Do you have a big Sales rep team? What do you do to remind them of the meeting with the customer? Well, this human burden is now under this rich software called CRM. It is a one-stop-shop embedded with unrivaled features. An automated reminder here helps your sales team with upcoming meetings, follow-up activities, and much more. Time to bring changes in Sales management and make it more interesting and hassle-free.

Use the Facility of Mobile CRM

A CRM in Banks can save you Time and Money. Remember how painful it was to switch to different tabs to see customers’ information at the same time. Having the versatile CRM in business keeps every information on a single platform. It never makes your work complicated. Better to spend less time garnering crucial data and focus more on making an everlasting relationship with your customers. However, some like to operate everything from mobile devices. No need to fret because many software offers a Mobile CRM facility. It shares the same incomparable experience as you are getting from your system at the office.

Currently, focusing on the same sales channel? Yes? You are just leaving money on the table. Your bank business should choose the CRM that assists in segmenting your customers related to demographics and purchases. This will be very helpful for the banking business because they can increase cross-selling numbers. Please note this benefit of CRM for your company. And yes, you will stay closer to the customer in this situation.

Best software CRM in Banks

You don’t need to search for the software which one to adapt. Check out the list below and select according to your needs.

- Zoho CRM

- Hubspot CRM

- Pipedrive

- Nimble

- Keap

- Freshdesk